Before we dive into what market failure is, let’s get familiar with some terms related to market failure:

Public goods: goods that can be used by the general public, from which they will benefit. Their consumption can’t be measured, and thus cannot be charged a price for (this is why a market economy doesn’t produce them). Examples include street lights and roads.

Merit goods: goods which create a positive effect on the society and ought to be consumed more. Examples include schools and hospitals. The opposite is called demerit goods which include alcohol and cigarettes.

External costs (negative externalities) are the negative impacts on society (third-parties) due to production or consumption of goods and services. Example: the pollution from a factory.

External benefits (positive externalities) are the positive impacts on society due to production or consumption of goods and services. Example: better roads in a neighbourhood due to the opening of a new business.

Private costs are the costs to the producer and consumer due to production and consumption respectively. Example: the cost of production.

Private benefits are the benefits to the producer or consumer due to production and consumption respectively. Example: the better immunity received by a consumer when he receives a vaccine.

Social Costs = External costs + Private Costs

Social Benefits = External benefits + Private benefits

Market Failure

Market failure occurs when the price mechanism fails to allocate resources effectively. This is the most disadvantageous aspect to the market economy. Causes of market failure are:

- When social costs exceed social benefits (especially where negative externalities (external costs) are high).

- Over-provision of demerit goods like alcohol and tobacco: the external costs arising from demerit goods are not reflected in the market and so they are overproduced.

- Under-provision of merit goods such as schools, hospitals and public transport, since the external benefits of these goods are not reflected in the market, they are underproduced.

- Lack of public goods such as roads, bus terminals and street lights: since their consumption cannot be measures and charged a price for, they are not produced by the private sector.

- Immobility of resources: when resources cannot move between their optimal uses and thus are not used to the maximum. For example, when workers (labour) don’t have occupational or geographic mobility.

- Information failure: when information between consumers, producers and the government are not efficiently and correctly communicated. Example: a cosmetics firm advertises its products as healthy when it is in fact not. The consumers who believe the firm and use its products might suffer skin damage.

- Abuse of monopoly* powers: monopolistic businesses may use their powers to charge consumers a high price and only produce products they wish to, since they know consumers have no choice but to buy from them.

*Monopoly: a single supplier who supplies the entire market with a particular product, without any competition. Example: public utilities like water, gas and electricity in many countries are provided by their respective governments with no other producer allowed in the market.

2.11 – Mixed Economic System

In a mixed economic system, both the market and government intervention co-exist. Examples include almost all countries in the world (India, UK, Brazil etc.). This is because it overrides all the disadvantages of both the market and planned (govt. only) economies. It identifies the importance of the price mechanism in operating an efficient resource allocation and also the role of the government in correcting (any) market failures.

Features:

- both the public and the private sector exists

- planning and final decisions are made by the govt. while the market system can determine allocation of resources owned by it, along with the public organizations.

Advantages:

- The govt. can provide public goods, necessities and merit goods. The private businesses can provide profitable and most-demanded goods (luxury goods, superior goods). Thus, everyone is provided for.

- The govt. will keep externalities, monopolies, harmful goods etc. in control.

- The govt. can provide jobs in the public sector (so there is better job security).

- The govt. can also provide financial help to collapsing private organizations, so jobs are kept secure.

Disadvantages:

- Taxes will be imposed, which will raise prices and also reduce work incentive.

- Laws and regulations can increase production costs and reduce production in the economy.

- Public sector organizations will still be inefficient and will produce low quality goods and services.

The specific ways in which the government, in a mixed economic system, can correct market failures of the market:

- Legislation and regulation – the government can make laws that regulate market activity, for example, prohibit smoking in public (which would cause a negative externality). One important kind of legislation the govt. can undertake is price controls – setting a minimum price or maximum price on goods.

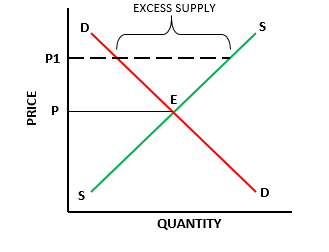

Minimum price or price floor is set to control a decreasing tendency of price. The minimum wage laws in many countries are an example of minimum price. The government sets the minimum wage above the existing market equilibrium wage, to ensure that all workers get a basic minimum wage to sustain them. But even as low-income workers now get better wages, the higher wage will cause the demand for labour to contract, as shown in the diagram to the left. There will also be higher supply of labour (workers who want work) because of higher wages. A reduced demand and increased supply will cause excess supply of labour i.e., unemployment.

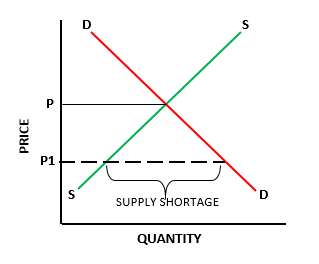

Minimum price or price floor is set to control a decreasing tendency of price. The minimum wage laws in many countries are an example of minimum price. The government sets the minimum wage above the existing market equilibrium wage, to ensure that all workers get a basic minimum wage to sustain them. But even as low-income workers now get better wages, the higher wage will cause the demand for labour to contract, as shown in the diagram to the left. There will also be higher supply of labour (workers who want work) because of higher wages. A reduced demand and increased supply will cause excess supply of labour i.e., unemployment. Maximum price or price ceiling is set to control an increasing tendency of price. It is usually set on rent (this is called rent control), to ensure that low-income tenants can afford to rent homes. But as a result of the lower rent, landlord will stop renting more homes, causing supply to contract, as shown in the diagram to the left. At the same time, lower rent will increase the demand for homes. A reduced supply of homes and higher demand for them will cause a shortage of supply in relation to demand.

Maximum price or price ceiling is set to control an increasing tendency of price. It is usually set on rent (this is called rent control), to ensure that low-income tenants can afford to rent homes. But as a result of the lower rent, landlord will stop renting more homes, causing supply to contract, as shown in the diagram to the left. At the same time, lower rent will increase the demand for homes. A reduced supply of homes and higher demand for them will cause a shortage of supply in relation to demand. - Direct provision of merit and public goods – since there is little incentive for the price mechanism to supply these goods, governments usually provide them. For example, free education, free healthcare, public parks. One way the govt. can do this is by nationalising certain products it considers essential to be provided by a governing authority, rather than the market. For example, in India, the government operates the only railway network because only it can provide cheap services to its millions of poor, daily passengers.

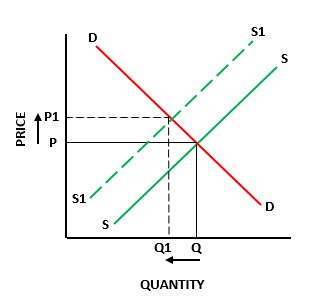

- Taxation on products – imposing a tax on products (indirect taxes) with negative externalities can discourage its production and consumption. For example, a tax on tobacco will make it expensive to produce and consume. In the diagram below, a tax has been imposed on a product, causing its supply to shift from S to S1. The price rises from P to P1 because of the additional tax amount, and the quantity traded in the market falls from Q to Q1.

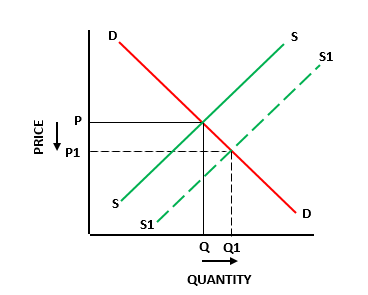

- Subsidies – a subsidy is a grant (financial aid) on products that have a positive externality. Subsidising, for example, cooking gas for the poor, will increase the living standard of the population. In the diagram below, a subsidy has been imposed on a good, causing its supply to shift from S to S1. It results in a fall in price from P to P1 and subsequently, an increase in the quantity traded in the market from Q to Q1.

*Note: movements along a demand or supply curve of a good only happen as a result of a direct change in price of the good; changes caused by any other factor, tax and subsidy included, is represented by a shift in the curves. - Tradable permits – firms will have to buy permits from the government to do something, for example, pollute at a certain level, and these can be traded among firms. Since permits require money, firms will be encouraged to pollute less.

- Extension of property rights – one of the main reasons for pollution in public spaces is that it is public – it does not harm a specific private individual – the resource is the government’s who cannot charge compensations easily. So the government can extend property rights (right to own property) of public places to private individuals. This will effectively privatise resources, create a market for these spaces and then individuals can be fined for polluting

- International cooperation among governments – governments work together on issues that affect the future of the environment.

As you can see, market failure can be corrected by governments in a variety of ways and the presence of a government is quite indispensable in any modern economy. Planned (government-only) economies are too inefficient and free market (no government) economies result in market failures. So a mixed economic system tries to balance both sides. That being said, there are certain drawbacks to government intervention in an economy.

- Political incentives: this occurs when there is a clash between political and economics (because a government is a political entity with political incentives). For example, even though mining companies cause a lot of environmental damage, the government may encourage and promote their activities to garner political and financial support from them.

- Lack of incentives: in the free market, individuals have a profit incentive to innovate and cut costs, but in the public sector, such an incentive is absent since the government will pay them salaries regardless of their performance. So, even as the government provides certain public and merit goods directly to the people at low costs, they tend to be very inefficient.

- Time lags, information failure: these are some of the government failure arising because of a lack of incentive. Government offices and employees don’t have an incentive to provide timely services or give accurate information and this leads to very inefficient systems.

- Welfare effects of policies: government policies such as taxation and welfare payments distort the market. This means that such policies will influence demand and supply in the economy and cause markets to move away from the efficient points produced by a market system. For example, high corporate taxes will deter companies from expanding their operations and making more profits or deter new enterprises from entering the market. Unemployment benefits given out by the government may cause people to stay unemployed and receive free benefits instead of working.

Notes submitted by Lintha

Click here to go the next topic

Click here to go to the previous topic

Click here to go back to the Economics menu

The amount of time these notes can save is mind-boggling.

LikeLiked by 3 people

Thank you lintha this is really helpful

LikeLiked by 1 person

I think you forgot o add the definition, drawing and interpretation of diagrams to shows the effect of the Microeconomic policy labor and foreign exchange markets

LikeLike

I have detailed the effect of minimum price/wage on the labour market (maximum wages are very rare in the real world) and the effect of maximum price/price ceiling on the product market. You can apply the same principles to the foreign exchange market. I will try and put up a section focusing on the foreign exchange market in the next couple of days. Thank you!

LikeLike

do you cover everything on the IGCSE syllabus or are there some gaps we need to fill in on our own?

LikeLike

We’ve done our best to include everything in the syllabi and made notes by referring to various sources. If any topic is missing, please let us know ASAP.

LikeLike

Do include the problems with government intervention as that is the part of the syllabus now.

LikeLiked by 1 person

Nowadays, Microsoft isn’t a full monopoly though, however, I suggest you put the Central Bank of any country for minting money as a monopoly. I believe that no other organisation has the right and authority to mint money for the respective country. Correct me if I am wrong?

LikeLike

Thank you so much for this, it was really helpful for me !! 🙂

LikeLiked by 1 person

Welcome! Glad we could be of help!

LikeLike

A printable version please

LikeLiked by 1 person

Hi Ruhan!

That is an excellent suggestion and we will try and make them. But it might take a while as we’re still in the process of completing notes and mindmaps. In the meantime, you can simply print the webpages straight from your browser:

-On google chrome, click the three vertical dots on the top right corner and select print

-On Safari, click on the File menu and select print.

Hope that helps! 🙂

LikeLike

Thank you for the notes ❤️

LikeLike